Detailed content

Introduction

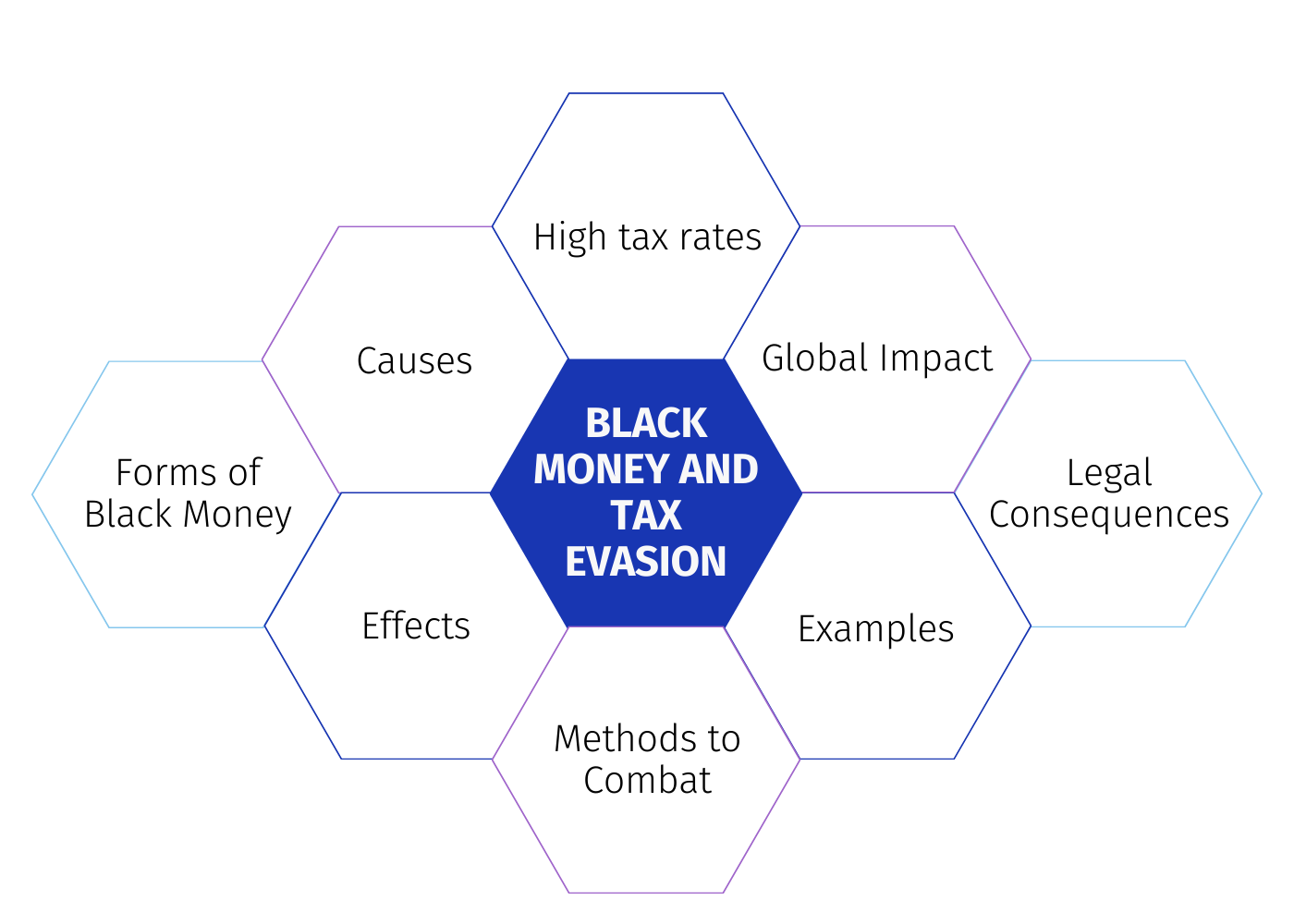

Block money and tax evasion are critical issues in the Indian economy, impacting its fiscal health, governance, and socio-economic development. In this essay, we'll delve into the complexities surrounding these phenomena, exploring their definitions, causes, consequences, and the measures undertaken to address them.

Definitions

Block Money: Block money refers to undisclosed or unaccounted funds typically held in cash or other assets outside the formal financial system. It includes money earned through legal or illegal means but not reported to tax authorities or regulatory bodies.

Tax Evasion: Tax evasion involves illegal activities aimed at reducing or avoiding tax liability, such as underreporting income, inflating expenses, or engaging in fraudulent practices to evade taxes.

Causes of Block Money and Tax Evasion in India

Complex Tax System: India's tax system is complex, with multiple layers of taxes, exemptions, and compliance requirements, making it challenging for individuals and businesses to navigate and comply fully.

High Tax Rates: High tax rates can incentivize taxpayers to evade taxes, especially when they perceive the tax burden as unfair or excessive.

Weak Enforcement: Inadequate enforcement mechanisms, including limited resources and capacity constraints of tax authorities, contribute to the prevalence of tax evasion.

Corruption: Widespread corruption facilitates tax evasion by allowing individuals and businesses to bribe tax officials or engage in illicit activities with impunity.

Informal Economy: A significant portion of economic activities in India occurs in the informal sector, where transactions often go unreported, leading to tax evasion.

Lack of Awareness: Many taxpayers may not fully understand their tax obligations or the consequences of non-compliance, leading to inadvertent evasion.

Cultural Factors: Cultural attitudes towards taxation, including a perception of taxes as a burden rather than a contribution to society, can also influence tax compliance behavior.

Consequences of Block Money and Tax Evasion

Revenue Loss: Tax evasion deprives the government of crucial revenue needed for public services, infrastructure development, and poverty alleviation programs.

Growing Income Inequality: Tax evasion exacerbates income inequality by allowing wealthy individuals and corporations to evade their fair share of taxes, widening the gap between the rich and the poor.

Undermined Governance: Block money and tax evasion undermine the effectiveness of governance institutions, eroding public trust and confidence in the government's ability to deliver essential services and enforce laws impartially.

Distorted Economic Growth: The presence of block money and tax evasion distorts economic indicators and policy formulation, leading to inefficient resource allocation and hindering sustainable economic growth.

Increased Burden on Honest Taxpayers: Tax evasion shifts the tax burden onto honest taxpayers, who must bear a disproportionate share of the tax burden to compensate for revenue losses.

Impact on Foreign Investment: High levels of tax evasion can deter foreign investors, who may perceive the business environment as risky or lacking transparency.

Measures to Combat Block Money and Tax Evasion

Simplification of Tax Laws: Simplifying tax laws and procedures can enhance compliance and reduce opportunities for evasion by making it easier for taxpayers to understand and fulfill their obligations.

Stricter Enforcement: Strengthening enforcement mechanisms, including increased monitoring, audits, and penalties for non-compliance, can deter tax evasion and improve compliance rates.

Promoting Financial Inclusion: Encouraging financial inclusion and formalization of the economy can help reduce the prevalence of block money by bringing informal transactions into the formal financial system.

Enhanced International Cooperation: International cooperation and information exchange agreements can help combat cross-border tax evasion and money laundering by tracking illicit financial flows and holding tax evaders accountable.

Public Awareness Campaigns: Educating the public about the importance of tax compliance and the consequences of evasion can foster a culture of voluntary compliance and discourage tax evasion.

Addressing Corruption: Implementing measures to tackle corruption within tax administration and other government agencies is crucial for reducing opportunities for tax evasion and improving overall governance.

Conclusion

In conclusion, block money and tax evasion pose significant challenges to the Indian economy, undermining fiscal sustainability, governance effectiveness, and socio-economic development. Addressing these issues requires a multifaceted approach encompassing legal reforms, enforcement measures, public awareness campaigns, and international cooperation. By tackling the root causes of tax evasion and promoting a culture of compliance, India can enhance revenue mobilization, promote equitable growth, and strengthen its position in the global economy.