Detailed content

1. Introduction to Financial Markets in India

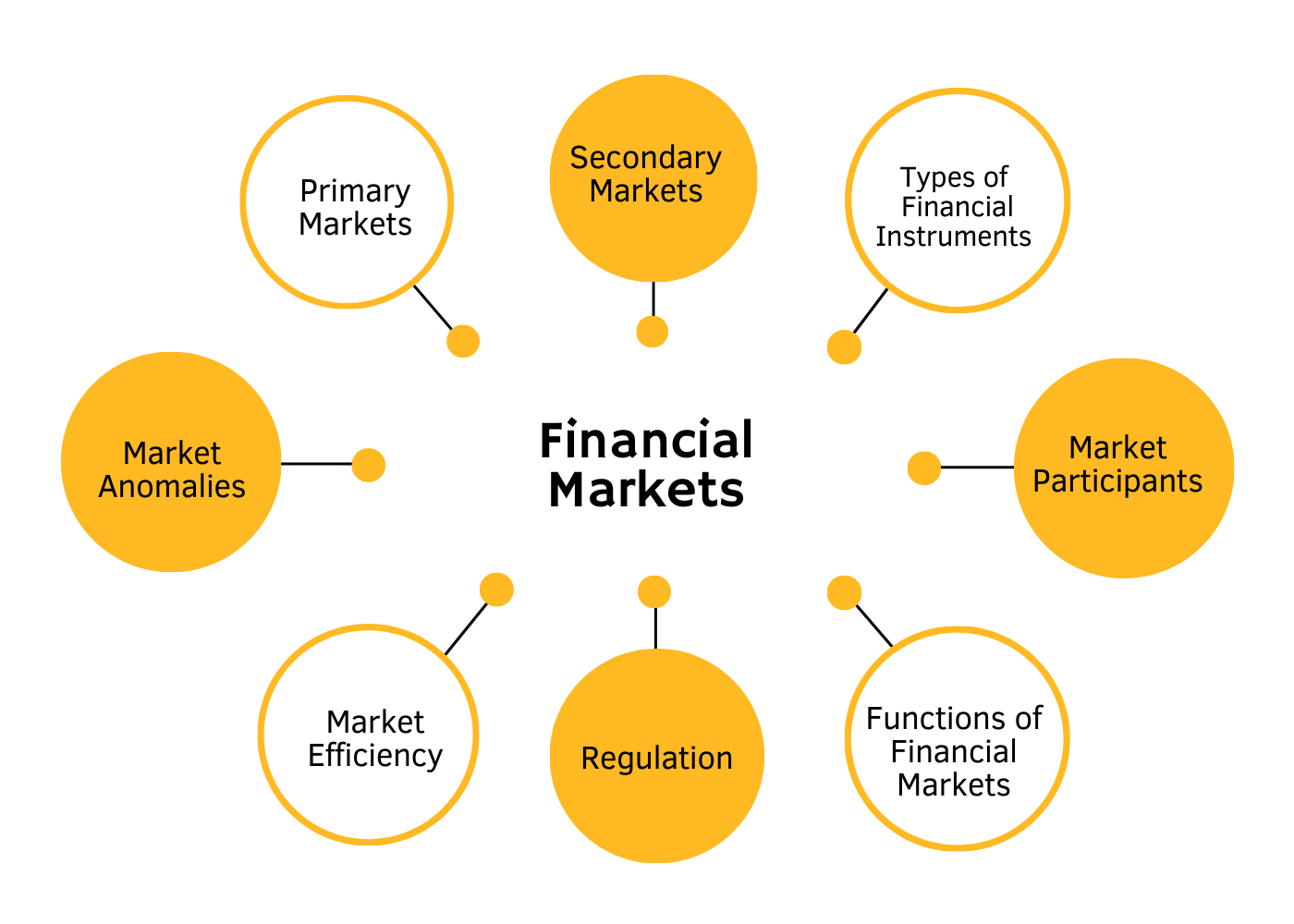

Financial markets in India have witnessed significant growth and evolution over the years, driven by economic reforms, globalization, technological advancements, and changing regulatory frameworks. These markets encompass a wide range of instruments and institutions, catering to diverse needs of investors and borrowers. The functioning of financial markets is crucial for mobilizing savings, channeling funds into productive investments, and facilitating efficient resource allocation.

2. Structure of Financial Markets

Money Market: The money market in India consists of various short-term instruments, such as Treasury Bills, Commercial Papers, Certificates of Deposit, and Repurchase Agreements (repos). It provides liquidity and short-term funding to market participants, including banks, corporations, and the government.

Capital Market: The capital market comprises the primary market, where new securities are issued, and the secondary market, where existing securities are traded among investors. Equity markets, debt markets, and derivatives markets are integral components of the capital market in India.

Foreign Exchange Market: The foreign exchange market facilitates the exchange of currencies, enabling international trade and investment flows. The Reserve Bank of India (RBI) plays a significant role in regulating the foreign exchange market and managing the country's foreign exchange reserves.

Commodity Market: The commodity market allows participants to trade in various commodities such as gold, silver, crude oil, agricultural products, and base metals. It provides a platform for hedging against price risks and speculation.

3. Participants in Financial Markets

Individuals: Individual investors participate in financial markets through various avenues such as stocks, bonds, mutual funds, and bank deposits. They invest for wealth creation, retirement planning, and meeting financial goals.

Corporations: Corporations raise capital from financial markets by issuing equity shares, bonds, and other debt instruments. They utilize funds for business expansion, capital expenditure, working capital requirements, and debt refinancing.

Banks and Financial Institutions: Banks play a pivotal role in financial intermediation by mobilizing deposits from savers and extending credit to borrowers. Financial institutions such as mutual funds, insurance companies, and non-banking financial companies (NBFCs) also actively participate in financial markets.

Government: The government raises funds from the financial markets through the issuance of Treasury Bills, Government Bonds, and other debt instruments. It utilizes the proceeds for financing budget deficits, infrastructure development, and welfare programs.

Regulators: Regulatory bodies such as the Securities and Exchange Board of India (SEBI), Reserve Bank of India (RBI), and Insurance Regulatory and Development Authority of India (IRDAI) oversee the functioning of financial markets, safeguard investor interests, and ensure market integrity.

4. Financial Instruments

Equity Instruments: Equity instruments represent ownership in a company and include stocks, preference shares, and equity mutual funds. Equity markets provide opportunities for capital appreciation and profit-sharing through dividends.

Debt Instruments: Debt instruments represent borrowing agreements between issuers and investors and include bonds, debentures, fixed deposits, and government securities. Debt markets offer fixed-income securities with periodic interest payments and capital preservation.

Derivative Instruments: Derivative instruments derive their value from underlying assets such as stocks, indices, currencies, or commodities. Futures, options, swaps, and forwards are commonly traded derivatives used for hedging, speculation, and risk management.

Foreign Exchange Instruments: Foreign exchange instruments facilitate the exchange of currencies at predetermined rates. Spot transactions, forwards, futures, and options are traded in the foreign exchange market, enabling participants to manage currency risks associated with international trade and investment.

Commodity Instruments: Commodity instruments allow investors to gain exposure to various commodities without physical ownership. Futures contracts, options, and exchange-traded funds (ETFs) are traded in commodity markets, providing hedging and investment opportunities.

5. Regulations and Regulatory Bodies

Securities and Exchange Board of India (SEBI): SEBI regulates the securities markets in India, overseeing stock exchanges, intermediaries, and listed companies. It formulates regulations, conducts inspections, and promotes investor education and awareness.

Reserve Bank of India (RBI): RBI is the central bank of India, responsible for monetary policy formulation, currency issuance, and regulation of the banking and financial system. It supervises banks, manages foreign exchange reserves, and maintains financial stability.

Forward Markets Commission (FMC): FMC regulates the commodity futures market in India, ensuring fair and transparent trading practices, risk management, and investor protection. It regulates commodity exchanges, brokers, and participants.

Insurance Regulatory and Development Authority of India (IRDAI): IRDAI regulates the insurance sector in India, overseeing insurers, insurance intermediaries, and insurance products. It aims to promote market integrity, consumer protection, and financial stability in the insurance industry.

Pension Fund Regulatory and Development Authority (PFRDA): PFRDA regulates pension funds and retirement savings schemes in India, promoting pension coverage, investment diversification, and retirement planning. It oversees National Pension System (NPS) and other pension products.

6. Recent Developments and Challenges

Technological Advancements: Financial markets in India have witnessed significant technological advancements, including electronic trading platforms, algorithmic trading, mobile banking, and digital payment systems. These innovations have enhanced market efficiency, transparency, and accessibility but have also raised concerns about cybersecurity and data privacy.

Financial Inclusion Initiatives: The Indian government has undertaken various initiatives to promote financial inclusion and expand access to financial services in rural and underserved areas. Jan Dhan Yojana, Aadhaar-based authentication, and Direct Benefit Transfer (DBT) schemes aim to bring the unbanked population into the formal financial system.

Regulatory Reforms: SEBI, RBI, and other regulatory bodies have implemented reforms to enhance market integrity, investor protection, and regulatory compliance. Measures such as risk-based supervision, corporate governance norms, and market surveillance mechanisms have been introduced to strengthen the regulatory framework.

Challenges and Risks: Financial markets in India face several challenges and risks, including volatility, liquidity constraints, systemic risk, regulatory gaps, and global economic uncertainties. Addressing these challenges requires coordinated efforts from regulators, market participants, and policymakers to ensure stability and resilience.

7. Conclusion

In conclusion, financial markets play a vital role in the Indian economy, serving as engines of growth, innovation, and wealth creation. The dynamic nature of these markets requires continuous adaptation to technological, regulatory, and market developments. By fostering transparency, efficiency, and investor confidence, Indian financial markets can contribute to sustainable economic development and inclusive growth.