Detailed content

Introduction to Monetary Policy in India

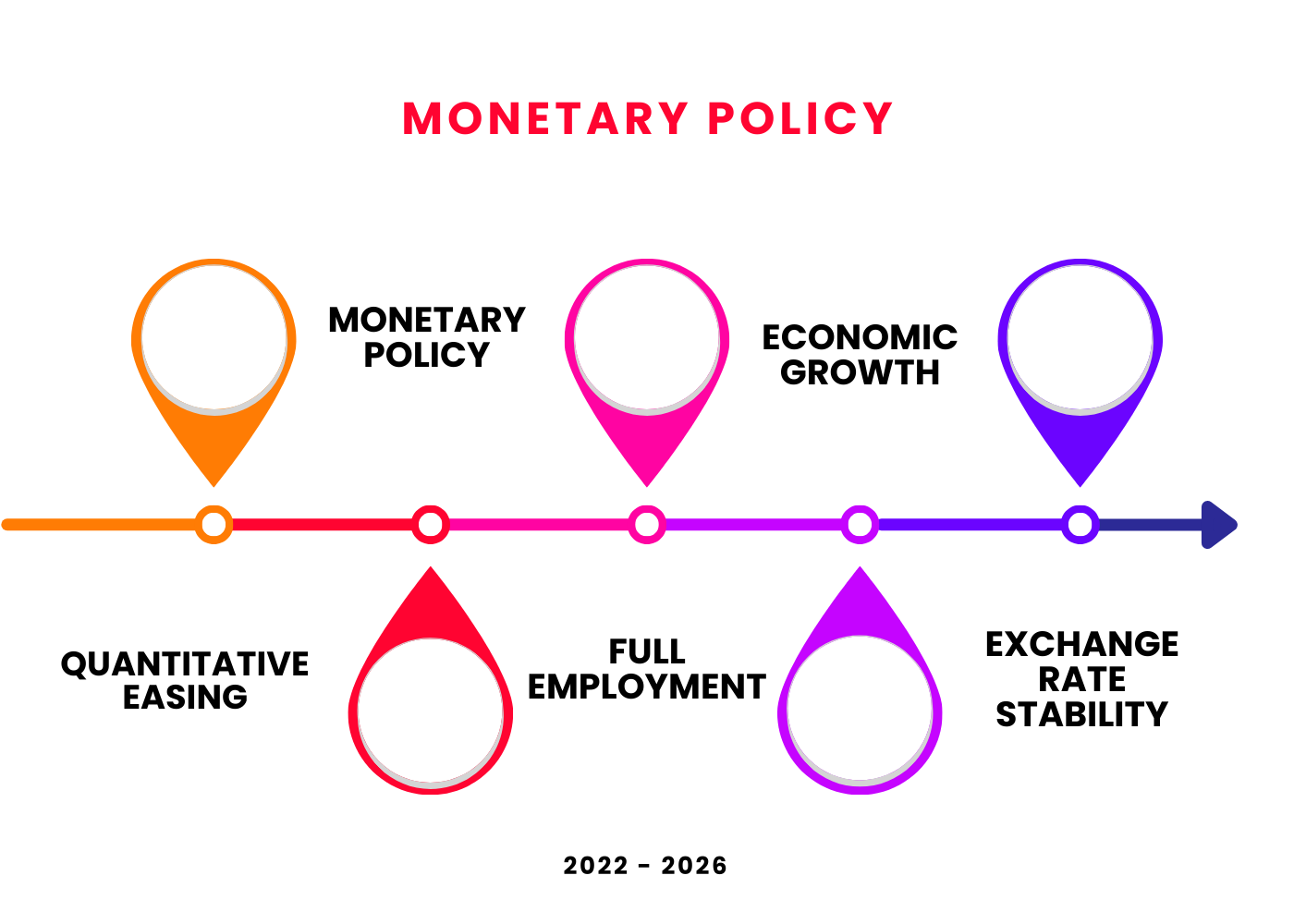

Monetary policy in India is formulated and implemented by the Reserve Bank of India (RBI), which is the country's central banking institution. It plays a crucial role in influencing the economic activity and maintaining price stability within the country. The primary objective of monetary policy in India, like in many other countries, is to achieve and maintain price stability while supporting the broader economic objectives such as high employment and sustainable economic growth.

Objectives of Monetary Policy in India

The primary objectives of monetary policy in India are

Price Stability: Price stability is one of the foremost objectives of monetary policy in India. The RBI aims to control inflation within a target range to ensure stable prices for goods and services. Stable prices foster confidence among consumers and businesses, encouraging investment and consumption.

Economic Growth:While maintaining price stability, monetary policy also aims to support economic growth. The RBI uses various tools to ensure adequate credit availability to productive sectors of the economy, thereby promoting investment, production, and employment opportunities.

Financial Stability: Monetary policy also focuses on maintaining financial stability within the economy. The RBI monitors and regulates the banking and financial system to prevent systemic risks and ensure the smooth functioning of financial markets.

Exchange Rate Stability: While India follows a managed floating exchange rate system, the RBI intervenes in the foreign exchange market to prevent excessive volatility in the exchange rate. Exchange rate stability is crucial for promoting international trade and investment.

Tools of Monetary Policy in India

The Reserve Bank of India (RBI) deploys various tools to implement monetary policy effectively. These tools can be broadly classified into conventional and unconventional tools.

Conventional Tools

a. Open Market Operations (OMOs):OMOs involve the buying and selling of government securities in the open market to regulate the money supply and interest rates. When the RBI purchases government securities, it injects liquidity into the system, leading to lower interest rates and vice versa.

b. Cash Reserve Ratio (CRR): CRR is the percentage of deposits that banks are required to maintain with the RBI in the form of reserves. By adjusting the CRR, the RBI controls the liquidity in the banking system. A higher CRR reduces the lendable funds of banks, leading to a decrease in money supply and vice versa.

c. Statutory Liquidity Ratio (SLR): SLR is the percentage of deposits that banks are required to maintain in the form of liquid assets such as cash, gold, or government securities. Similar to CRR, adjusting SLR helps regulate liquidity in the banking system.

d. Repo Rate: The repo rate is the rate at which the RBI lends short-term funds to commercial banks against government securities. Changes in the repo rate affect the cost of borrowing for banks, which, in turn, influences lending rates in the economy. A higher repo rate reduces liquidity, curbing inflation, while a lower repo rate stimulates economic activity.

e. Reverse Repo Rate: Reverse repo rate is the rate at which the RBI borrows funds from commercial banks. It acts as a tool for absorbing excess liquidity from the banking system. By increasing the reverse repo rate, the RBI encourages banks to park more funds with it, reducing the money supply.

f. Bank Rate: The bank rate is the rate at which the RBI lends funds to commercial banks for long-term periods. Although not frequently used, changes in the bank rate signal the RBI's stance on monetary policy and influence long-term interest rates.

Unconventional Tools

a. Quantitative Easing (QE): QE involves large-scale purchases of government securities or other assets by the central bank to inject liquidity into the economy. In India, QE-like measures have been adopted during periods of economic stress to support growth and maintain financial stability.

b. Forward Guidance: Forward guidance involves providing explicit guidance on the future path of monetary policy actions. Clear communication from the RBI regarding its policy intentions helps shape market expectations and guide economic behavior.

Implementation of Monetary Policy in India

The implementation of monetary policy in India involves a combination of quantitative and qualitative measures aimed at achieving the desired objectives. The Monetary Policy Committee (MPC), constituted by the Government of India, is responsible for setting the benchmark policy interest rates, namely the repo rate, based on the prevailing economic conditions and the inflation target.

The MPC conducts periodic meetings to review economic indicators such as inflation, growth, fiscal deficit, external sector developments, and global economic trends. Based on these assessments, the MPC decides on the appropriate stance of monetary policy, including changes in the repo rate and other policy measures.

Apart from MPC decisions, the RBI also employs various other instruments, such as OMOs, CRR, SLR, and regulatory measures, to fine-tune liquidity conditions and achieve the desired policy objectives.

Challenges and Criticisms

Despite its significance, monetary policy in India faces several challenges and criticisms

Transmission Mechanism: One of the key challenges is the effectiveness of monetary policy transmission mechanism, whereby changes in policy rates are transmitted to the real economy through changes in lending and borrowing rates. Structural bottlenecks in the financial system, such as high non-performing assets (NPAs), limited financial inclusion, and rigidities in interest rate adjustments, hamper the smooth transmission of monetary policy impulses.

Inflation Targeting: While inflation targeting has been adopted as the primary objective of monetary policy, achieving the inflation target amidst supply-side shocks and volatile food and fuel prices remains a challenge. External factors such as global commodity prices and exchange rate movements also influence domestic inflation dynamics, complicating the task of inflation management.

Liquidity Management: Maintaining adequate liquidity in the financial system without fueling inflationary pressures is another challenge for monetary policymakers. Balancing the conflicting objectives of supporting economic growth and containing inflation requires careful liquidity management and coordination with fiscal policy measures.

External Sector Dynamics: India's vulnerability to external shocks, such as changes in global financial conditions, capital flows, and exchange rate volatility, complicates the conduct of monetary policy. The RBI often needs to intervene in the foreign exchange market to stabilize the rupee, which may have implications for domestic liquidity conditions and inflation.

Policy Credibility: Credibility and transparency in monetary policy formulation and communication are essential for anchoring inflation expectations and guiding market behavior. Any perceived deviation from the stated policy objectives or inconsistency in policy actions can undermine the effectiveness of monetary policy and erode public confidence.

Conclusion

Monetary policy plays a crucial role in influencing the economic performance and stability of India. Through its various tools and measures, the Reserve Bank of India seeks to achieve the twin objectives of price stability and economic growth while ensuring financial stability and exchange rate management. However, the effectiveness of monetary policy implementation hinges on addressing structural bottlenecks, enhancing policy credibility, and adapting to evolving economic challenges. In navigating the complexities of the global economy and domestic imperatives, a judicious and forward-looking approach to monetary policy formulation and implementation is imperative for sustaining India's economic growth and development.