Detailed content

Introduction to Exchange Rates in Indian Economics

Exchange rates play a crucial role in the Indian economy, influencing trade, investment, inflation, and overall economic stability. In India, the exchange rate regime has evolved over the years, transitioning from fixed to managed float and finally to a largely market-determined exchange rate system. Understanding the dynamics of exchange rates in the context of Indian economics requires an analysis of various factors such as monetary policy, fiscal policy, external trade, capital flows, and global economic trends.

Historical Evolution of Exchange Rate Regime in India

India initially followed a fixed exchange rate regime after independence, pegging the Indian rupee to the British pound and later to the US dollar under the Bretton Woods system. However, in 1975, India shifted to a managed float system due to balance of payments crises and the need for greater flexibility in exchange rate management. Subsequently, in the early 1990s, India embarked on economic liberalization and adopted a more market-oriented exchange rate regime, allowing the rupee to be largely determined by market forces with periodic interventions by the Reserve Bank of India (RBI) to maintain stability.

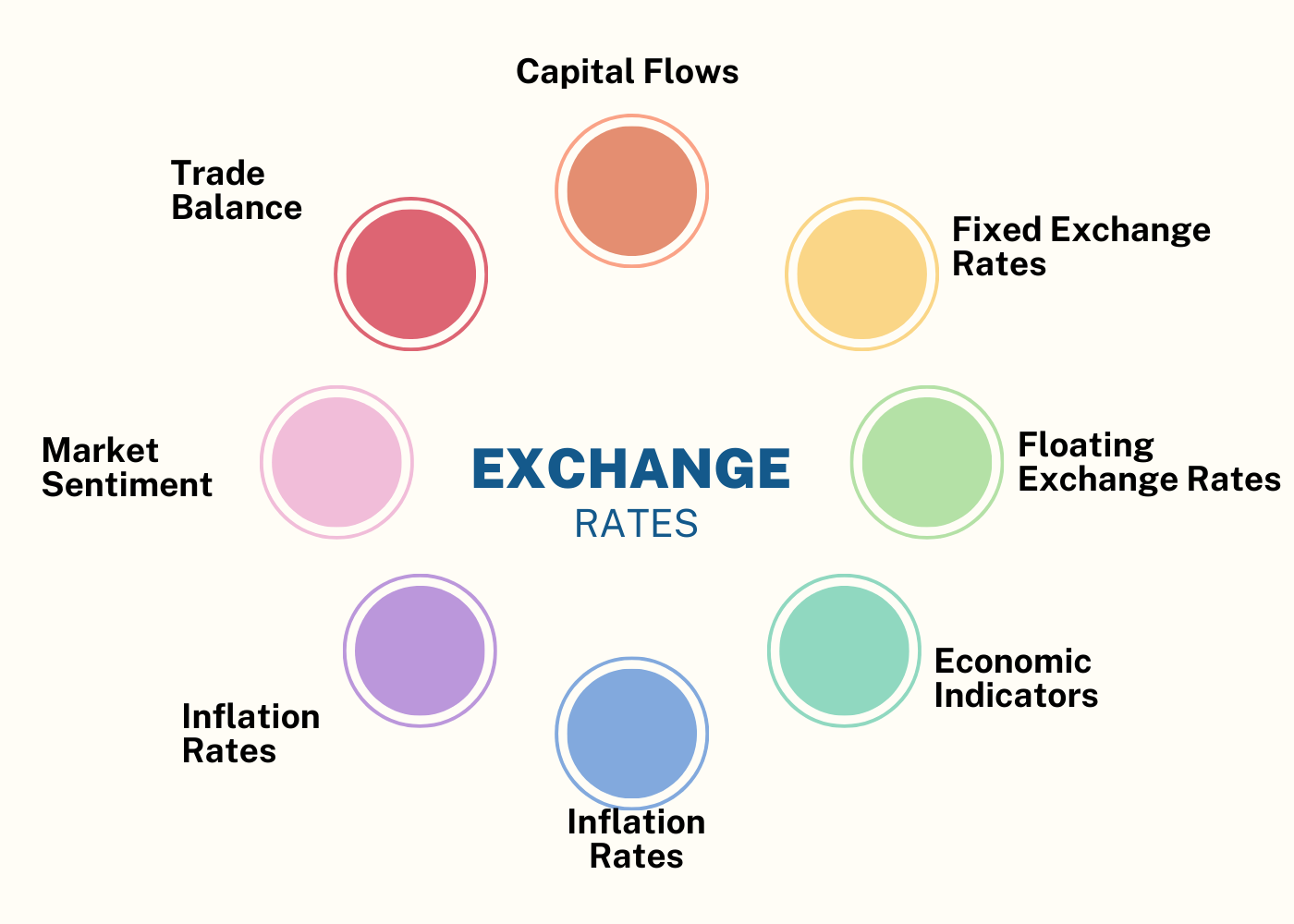

Determinants of Exchange Rates in India

Several factors influence exchange rates in the Indian context

Monetary Policy: The monetary policy stance of the RBI, including interest rate decisions, money supply management, and inflation targeting, directly impacts exchange rates. Tighter monetary policy typically leads to a stronger currency, while accommodative policies may lead to currency depreciation.

Fiscal Policy: Government fiscal measures such as taxation, public spending, and budget deficits affect investor confidence and overall economic stability, consequently influencing exchange rates.

Trade Balance: India's trade balance, including exports and imports of goods and services, has a significant bearing on exchange rates. A trade surplus tends to strengthen the currency, while a deficit exerts downward pressure on the currency.

Capital Flows: Foreign direct investment (FDI), foreign institutional investment (FII), and other capital flows into and out of India impact exchange rates. Fluctuations in capital flows can lead to volatility in exchange rates.

Global Economic Factors: Global economic trends, geopolitical events, commodity prices, and interest rate differentials between countries also influence exchange rates in India. For instance, a slowdown in global growth may lead to capital outflows and currency depreciation.

Exchange Rate Mechanism in India:

The RBI plays a pivotal role in managing exchange rates in India. While the rupee is largely determined by market forces, the RBI intervenes in the foreign exchange market to smoothen volatility and maintain orderly conditions. The RBI employs various instruments such as spot and forward transactions, foreign exchange reserves management, and monetary policy tools to achieve exchange rate stability. Additionally, the RBI periodically announces its stance on exchange rate management through monetary policy statements and interventions.

Impact of Exchange Rates on the Indian Economy:

Exchange rates have wide-ranging implications for the Indian economy

Trade Competitiveness: A competitive exchange rate can boost exports and improve the trade balance, contributing to economic growth and employment generation. However, an overvalued currency may hinder export competitiveness and exacerbate trade deficits.

Inflation Dynamics: Exchange rate movements influence import prices, which in turn affect domestic inflation. Currency depreciation can lead to imported inflation, especially for essential commodities and raw materials, impacting household purchasing power and overall price stability.

Capital Flows and Investment: Exchange rate volatility can affect investor confidence and capital inflows, impacting domestic investment and financial market stability. Foreign investors consider exchange rate movements alongside other factors when making investment decisions in India.

External Debt Sustainability: Fluctuations in exchange rates can affect the servicing of external debt denominated in foreign currencies. A depreciating rupee may increase the cost of servicing external debt, posing challenges to external debt sustainability and macroeconomic stability.

Challenges and Policy Implications:

Despite the benefits of a flexible exchange rate regime, India faces several challenges in managing exchange rates

Volatility and Speculation: Exchange rate volatility and speculative activities in the foreign exchange market pose challenges to exchange rate stability and macroeconomic management. The RBI employs prudential measures and intervention strategies to mitigate excessive volatility.

External Vulnerabilities: India's reliance on external financing, fluctuations in oil prices, and global economic uncertainties expose the economy to external vulnerabilities. Policy measures aimed at enhancing resilience to external shocks are essential for maintaining exchange rate stability.

Structural Reforms: Structural reforms aimed at enhancing export competitiveness, improving productivity, and diversifying the export basket are crucial for addressing long-term imbalances in the external sector and promoting sustainable exchange rate management.

In conclusion, exchange rates play a critical role in shaping India's economic performance and external sector dynamics. A holistic understanding of the determinants, mechanisms, and implications of exchange rate movements is essential for policymakers to formulate appropriate strategies aimed at promoting exchange rate stability, fostering economic growth, and enhancing external resilience in the Indian economy.