Detailed content

Introduction

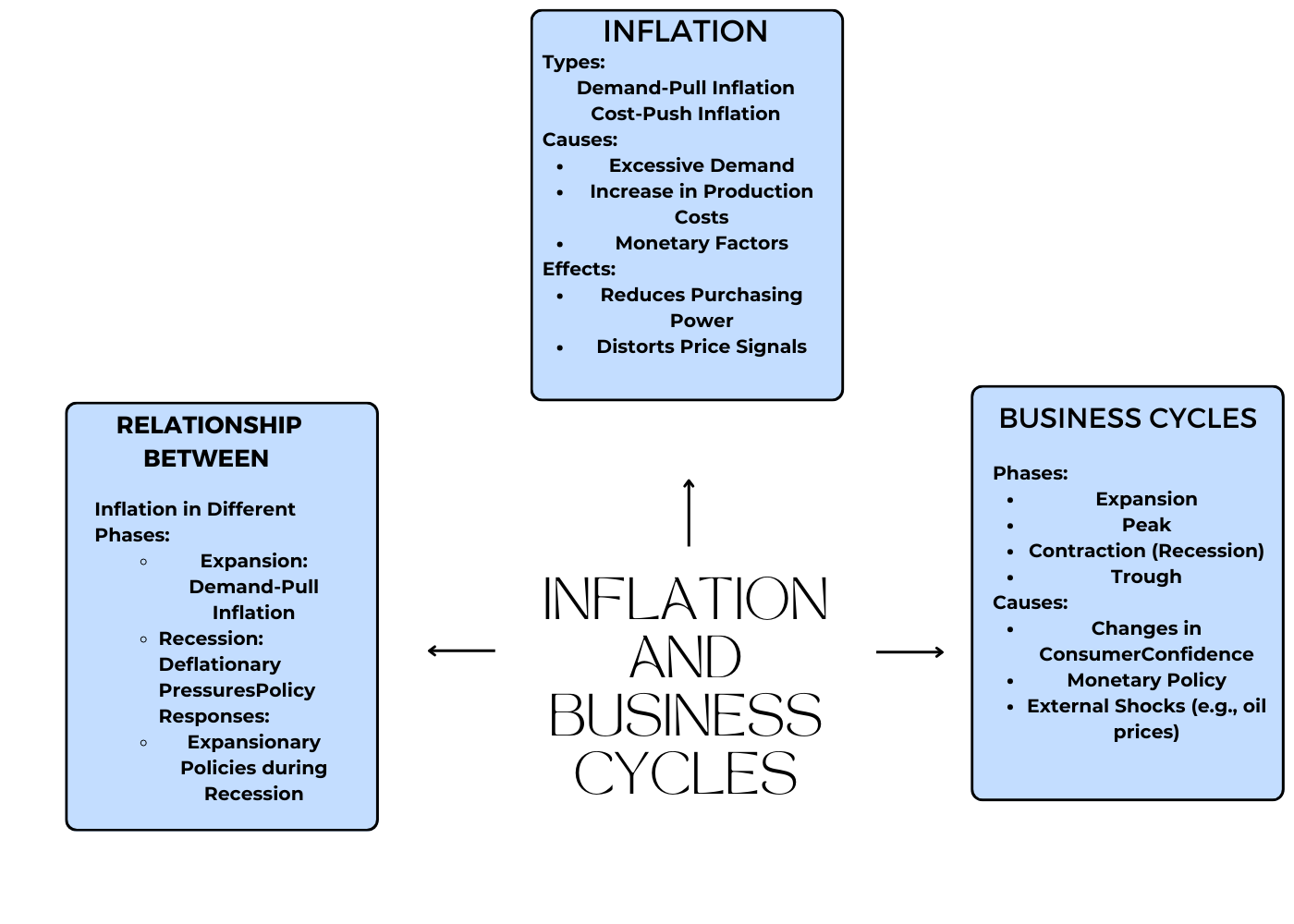

Inflation and business cycles are critical phenomena in economics, shaping the trajectory of economies worldwide, including in India. Inflation refers to the sustained increase in the general price level of goods and services in an economy over a period of time, while business cycles refer to the fluctuations in economic activity characterized by periods of expansion and contraction. Understanding these phenomena in the Indian context involves analyzing various factors such as government policies, monetary dynamics, structural changes, and global economic influences.

Factors Influencing Inflation in India

Monetary Policy

• The Reserve Bank of India (RBI) plays a crucial role in managing inflation through its monetary policy tools. The RBI's primary objective is to maintain price stability while supporting economic growth. It achieves this through mechanisms such as interest rate adjustments, open market operations, and reserve requirements.

• Interest rate adjustments, specifically the repo rate, influence borrowing costs for banks and ultimately affect consumer spending and investment. By raising the repo rate, the RBI aims to curb inflationary pressures by reducing aggregate demand. Conversely, lowering the repo rate stimulates economic activity but may lead to higher inflation if not managed effectively.

• Open market operations involve buying and selling government securities to regulate the money supply in the economy. By purchasing securities, the RBI injects liquidity into the system, promoting economic growth. Conversely, selling securities reduces liquidity, helping to contain inflationary pressures.

• Reserve requirements refer to the proportion of deposits that banks must hold as reserves. Adjusting these requirements impacts the availability of credit in the economy, influencing spending and inflationary pressures.

Fiscal Policy

• The government's fiscal policy, including taxation and public expenditure, also affects inflation dynamics. Fiscal deficits, arising from excessive government spending relative to revenue, can lead to inflationary pressures by increasing aggregate demand without a corresponding increase in output.

• Tax policies, such as indirect taxes on goods and services, directly influence consumer prices. Changes in tax rates can either mitigate or exacerbate inflation depending on their impact on demand and production costs.

Supply-side Factors

• Supply-side factors such as agricultural productivity, infrastructure development, and supply chain efficiency significantly influence inflation in India. Agricultural output plays a crucial role due to the large share of the population dependent on the sector for livelihood. Poor harvests or supply disruptions can lead to food price inflation, affecting overall inflationary trends.

• Infrastructure bottlenecks, including inadequate transportation and storage facilities, can exacerbate supply shortages and increase production costs, contributing to inflationary pressures. Improving infrastructure investments can help alleviate these constraints and promote supply-side efficiency.

Exchange Rate Dynamics

India's exchange rate movements vis-à-vis major currencies also impact inflation dynamics, particularly for import-dependent sectors. A depreciating currency can lead to higher import costs, translating into higher prices for imported goods and services. This effect can spill over to domestic production through increased input costs, contributing to inflation.

Business Cycles in India

Phases of the Business Cycle

The Indian economy experiences distinct phases within the business cycle, including expansion, peak, contraction, and trough. During the expansion phase, economic activity increases, characterized by rising output, employment, and investment. Peaks represent the highest point of economic activity, after which the economy enters a contraction phase marked by declining output and rising unemployment. Troughs denote the lowest point of the cycle, from which the economy begins to recover and enter a new expansion phase.

Drivers of Business Cycles

Several factors drive business cycles in India, including domestic and external influences:

Monetary Policy: The RBI's monetary policy actions influence interest rates, credit availability, and investment decisions, impacting economic activity and business cycles.

Fiscal Policy: Government spending, taxation, and budgetary policies influence aggregate demand and investment, affecting business cycle fluctuations.

Global Economic Conditions: India's economy is increasingly interconnected with global markets, making it susceptible to external shocks such as changes in commodity prices, financial market volatility, and geopolitical events.

Structural Reforms: Structural reforms aimed at enhancing productivity, efficiency, and competitiveness can influence business cycles by affecting long-term growth prospects and short-term adjustment processes.

Sectoral Dynamics

India's business cycles exhibit sectoral variations, with certain industries more cyclical than others. For instance, industries such as construction, manufacturing, and trade are typically more sensitive to economic fluctuations, experiencing sharper contractions and expansions compared to sectors like healthcare and education, which are relatively stable.

Policy Responses

Governments and central banks respond to business cycle fluctuations through various policy measures:

Monetary Policy: During economic downturns, central banks may lower interest rates and implement quantitative easing measures to stimulate investment and consumption. Conversely, during periods of overheating, central banks may raise interest rates to curb inflationary pressures.

Fiscal Policy: Governments may adjust fiscal policy by increasing public spending on infrastructure projects or providing tax incentives to stimulate demand during recessions. Conversely, during periods of high inflation, governments may reduce spending or increase taxes to cool down the economy.

Case Study: Recent Trends in Inflation and Business Cycles

Post-Pandemic Recovery

The COVID-19 pandemic had profound effects on India's economy, leading to a sharp contraction followed by a gradual recovery. During the initial phase of the pandemic, strict lockdown measures disrupted supply chains, leading to supply shortages and inflationary pressures, particularly in essential goods.

Monetary Response

In response to the economic downturn, the RBI implemented several monetary policy measures to support growth and manage inflation. These measures included interest rate cuts, liquidity injections, and regulatory forbearance to ease financial stress on businesses and households.

Fiscal Stimulus

The government also introduced fiscal stimulus packages aimed at reviving economic activity and providing relief to affected sectors. These measures included income support schemes, credit guarantees for small businesses, and infrastructure spending to generate employment and stimulate demand.

Inflation Dynamics

Inflationary pressures fluctuated during the pandemic, initially driven by supply disruptions and later by demand-side factors. Food inflation surged due to supply chain disruptions and hoarding during the lockdowns, while core inflation remained subdued amid weak demand and excess capacity.

Business Cycle Recovery

Following the initial contraction, India's economy gradually rebounded as lockdown restrictions eased and economic activity resumed. High-frequency indicators such as manufacturing PMI, industrial production, and consumer sentiment improved, signaling a recovery in business activity.

Challenges Ahead

Despite the recovery, India faces several challenges in sustaining economic momentum and managing inflation:

Supply Chain Disruptions: Lingering supply chain disruptions and logistical challenges could continue to exert inflationary pressures, especially in essential goods and commodities.

Structural Reforms: India requires continued structural reforms to enhance productivity, competitiveness, and resilience to external shocks, thereby fostering sustainable economic growth and stability.

Global Uncertainties: Geopolitical tensions, trade disputes, and other global uncertainties pose risks to India's economic outlook, affecting trade, investment, and inflation dynamics.

Conclusion

Inflation and business cycles are intrinsic features of the Indian economy, influenced by a myriad of domestic and external factors. Effective policy responses aimed at managing inflation, promoting growth, and stabilizing business cycles are crucial for ensuring macroeconomic stability and sustainable development. As India continues its economic journey, policymakers must remain vigilant, adaptive, and proactive in addressing emerging challenges and seizing opportunities for inclusive and resilient growth.